01 June 2009, by Martin Goh, Echelon Risk Consulting Asia Pte Ltd

Setting the Scene

Managing risks, increasing profitability and going `green' - Objectives that can converge to help your firm be more successful or is that simply wishful thinking?

On the surface it would seem that the above objectives are uncorrelated. However, that would perhaps be jumping to a somewhat presumptuous conclusion. Let's look at the issue at hand in a little more detail, try to extrapolate a thread of commonality through the objectives and see how/if they apply to your firm.

Impact of Climate Change and Risk Management

It's been well reported that we are facing a daunting and ever more critical climate crisis. As economist Nicholas Stem pointed out,

[1]'We need strong international agreement to deal with the climate crisis... The longer we delay, the more the greenhouse gasses build up, the more difficult the starting point for action becomes'. It's perhaps tempting to think that such statements about the environment relate more to Greenpeace or companies that engage in oil exploration than the legal practice.

Before we get too carried away though, let's keep in mind that the environment is everyone's problem. Let's face it: If the environment (and the earth) goes down the toilet, then we will be going down with it. Unless you have plans to move to Mars, now is as good a time as any to get serious about going 'green'.

It is reasonable to conclude that risks (to an organisation) associated with climate do not necessarily arise directly from changes to climate but from consequences that may directly affect the organisation's capacity to serve its clients or stakeholders. Such a perspective certainly makes the risks associated with climate change and its potential effect on your firm more salient. This is the perspective that frames the guide published by the Australian Greenhouse Office, in the Department of the Environment and Heritage - 'Climate Change Impacts & Risk Management - A Guide for Business and Government'.

[2]

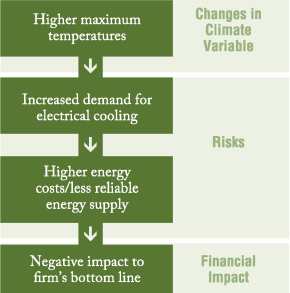

The guide seeks to provide organisations with a framework to identify, assess, prioritise and mitigate risks associated with climate change that would be relevant to their business. It advises businesses to examine links between climate change and risk and how these causal links affect their organisation. The figure below shows an example of the link between climate change, risk and organisational impact:

The guide states that climate change is likely to have pervasive effects that will be felt in some way by every person and every organisation, and at all levels, from strategic management to operational activities. The effects will impact across environmental issues, economic performance, social behaviour, infrastructure and other aspects of human existence.

This alludes to what must be an obvious realisation - Our actions or inactions can contribute to dramatic changes in climate variables that will have drastic implications to our business and more importantly, our lives. So if you still think climate change risk management has little to do with the legal practice, maybe it's time for a paradigm shift.

Case-in-point: Arnold & Porter, a law firm in Washington, DC, found out through an informal survey in 2006 that annual paper use per attorney (in the US) ranges from about 20,000 to about 100,000 sheets.

[3]

Producing paper is very energy-intensive - According to the web site of the ABA-EPA Climate Challenge, `The life-cycle of one ton of office paper, from production to disposal in a landfill, results in the release of about 11 tons of carbon dioxide-equivalent gases, which contribute to global climate change; as well as other air and water pollutants'.

Would you fancy having significantly higher electricity bills during the next economic downturn?

Going 'Green'

So how do we start going 'green'?

You can choose to take a formalised and structured approach, as suggested by the Australian Greenhouse Office, and use the AS/NZS 4360 Risk Management Standard.

If you feel that this is too daunting or perhaps not applicable for your practice, you can start small and simply choose to make a difference with practical steps such as:

-

Turning off electrical devices that you are not using - eg Lights in the offices where no one is working, appliances that don't need to stay on at night and computers not in use.

-

Take advantage of digital media to keep electronic files (where possible). With today's technology, documents can be scanned, emailed, posted to the web, downloaded, and carried anywhere with the help of a laptop or flash drive.

-

Utilise natural light - Proper windows with open shades or curtains allow enough light into the office so that you use less artificial light.

-

Recycle.

-

Set goals. For example, you might set a goal to lower your monthly electric bill by 10%. Contests and rewards can be set up for achieving such 'green' goals, and going above and beyond expectations.

-

Use energy-saving light bulbs - Compact Fluorescent Light Bulbs ("CFLs") require 75% less energy and last ten times longer than conventional ones.[4]

A Dose of Inspiration

Sometimes going 'green' can be met with skepticism, obstacles and maybe even a belief that it's all talk and no company in the real world is actually doing it. The following might help:

DLA Piper[5]

Introduced global sustainability initiative to reduce the impact of the firm's operations on the environment.

This includes installing more energy-efficient lights and machines in offices, encouraging more recycling and duplex printing and copying of documents.

The firm is also offering USD2,000 to employees - excluding partners - who purchase hybrid cars and USD1,500 to those who lease them.

MantaCole[6]

A US law firm that has implemented a paperless system that saves an estimated 12 trees per year.

MantaCole's paperless system has allowed attorneys to deliver all their services in a more streamlined and productive manner, which has resulted in double-digit increases in growth since the company opened in 2004.

The Equator Principles [7]

Based on the policies of the World Bank and its private sector arm, the International Finance Corporation, the Equator Principles serve as a financial industry benchmark for determining, assessing and managing social and environmental risk in project financing.

Project financiers may encounter social and environmental issues that are both complex and challenging.

Equator Principles Financial Institutions ("EPFIs") have consequently adopted these Principles in order to ensure that the projects they finance are developed in a manner that is socially responsible and reflect sound environmental management practices.

By doing so, negative impacts on project-affected ecosystems and communities should be avoided where possible, and if these impacts are unavoidable, they should be reduced, mitigated and/or compensated for appropriately.

So far, 67 financial institutions have adopted the Equator Principles, including companies such as Bank of Tokyo-Mitsubishi UFJ, Citigroup, HSBC, ING Group and Standard Chartered Bank.

Concluding Thoughts

I hope this article has shed some light on how managing risks, increasing profitability and going 'green' can converge as worthy objectives to be easily and simultaneously pursued.

Let's be frank though - The motivation behind going 'green' for most businesses is as much about saving the world as it is about the bottom line - Attracting new clients and hires, saving costs on paper and energy bills.

So altruism takes a little bit of a back seat, but does that matter in the bigger picture? Going 'green' is the right thing to do, it's perceived well by clients, it's mostly low cost, adds to the bottom line (and possibly top line) and yes, it helps save the world at the same time.

Don't want to consider going 'green' because climate risks are irrelevant to your firm? Now that's wishful thinking...

[1] Connecting climate change and economic recovery - Economist Nicholas Stern discusses the downturn and its effect on the climate change agenda. The McKinsey Quarterly, March 2009.

[3] Debra Cassen Weiss, ABA Journal, 19 Sept 2007.

[4] Debra Cassens Weiss, ABA Journal, 19 Sept 2007.

[5] US Government of Energy (Energy Star).

[6] Maria Kantzavelos, "Firms Taking Steps to Reduce Environmental Footprints", Chi Law, September 2007.

[7] The ‘Equator Principles’, July 2006.